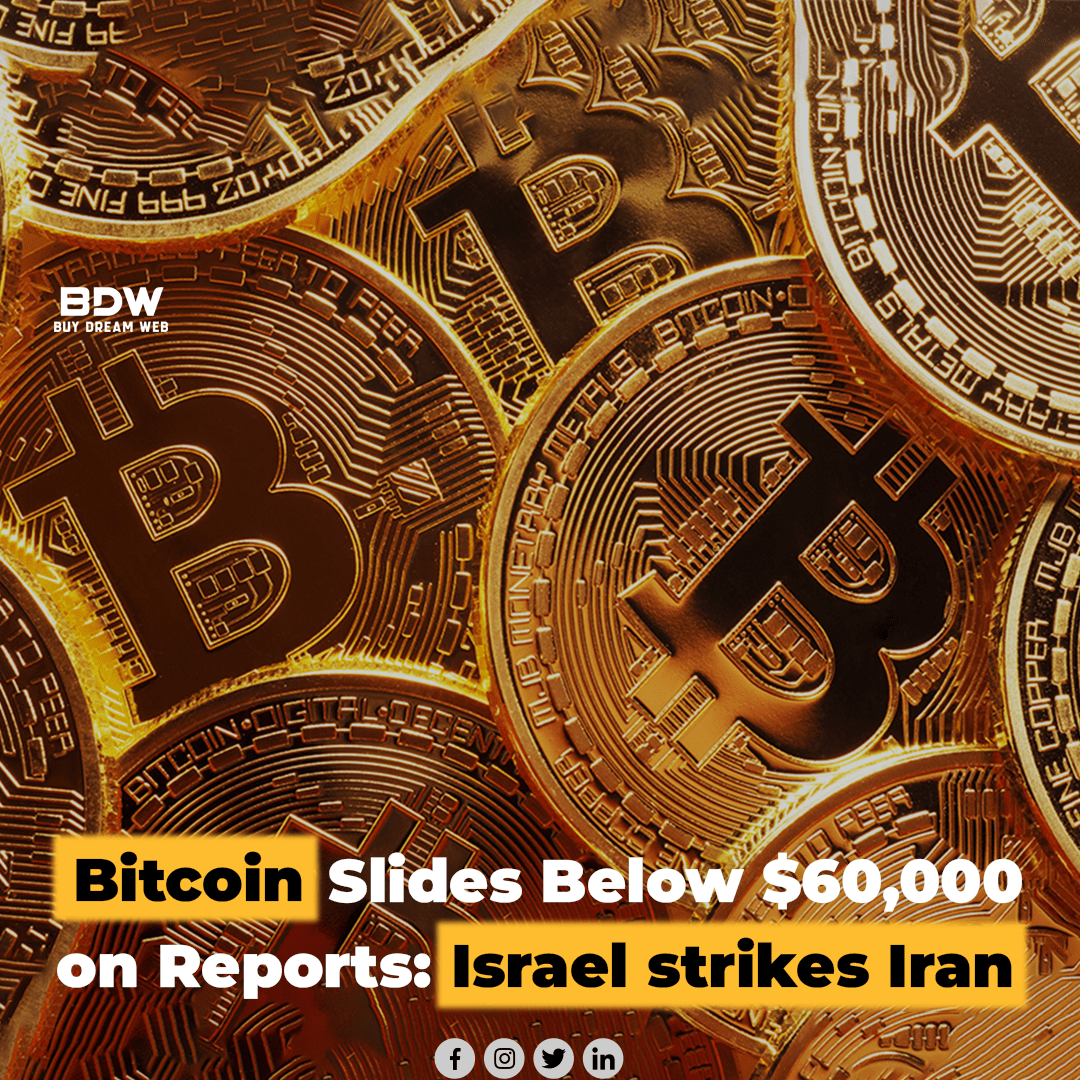

Bitcoin Tumbles on Geopolitical Jitters: Unpacking the Market Slide

The world of cryptocurrency witnessed another sharp correction recently, most prominent digital asset, plummeting below crucial $60,000 mark. This blog delves into potential reasons behind sudden price drop, explores complex relationship between cryptocurrency markets and geopolitical tensions. It examines the broader implications for the future of it and other digital currencies.

A Cryptocurrency Earthquake: Bitcoin Loses Ground

On April 19, 2024, Bitcoin prices experienced a significant downturn, dropping below the psychologically important $60,000 threshold. This decline came amidst reports of a potential escalation in tensions between Israel and Iran. Here’s a breakdown of the situation:

- Market Jitters: Cryptocurrency markets are known for their sensitivity to external factors, including news events and global uncertainties. The reports of Israeli missile strike on Iran triggered risk-off sentiment among investors, leading them to move away from volatile assets.

- Flight to Safety: Investors often seek safer havens during times of geopolitical tensions. This can include traditional assets like gold and US dollar, leading to decrease in demand for riskier assets.

- Correlation with Traditional Markets: While Bitcoin initially aimed for independence from traditional financial markets, some argue a correlation has emerged. Instability in traditional markets can spill over to the cryptocurrency sphere, leading to price fluctuations.

This incident highlights the complex interplay between geopolitical events and the price of Bitcoin.

Beyond the Headlines: Unveiling Other Potential Factors

While geopolitical tensions might have been the immediate trigger, other factors could be at play in price decline:

- Profit-Taking: As Bitcoin prices had been steadily climbing in the weeks leading up to drop, some investors might have chosen to cash out. and secure their profits, leading to temporary sell-off.

- Regulatory Scrutiny: Increased regulatory scrutiny from governments worldwide could be dampening investor enthusiasm for cryptocurrencies, leading to cautious approach from market participants.

- Technical Correction: From technical analysis perspective, Bitcoin might have been due for correction after sustained period of price increase. This could be a natural market adjustment after significant gains.

Understanding these diverse factors is crucial for a nuanced analysis of the Bitcoin price movement.

A Geopolitical Butterfly Effect: How Global Events Impact Crypto

The recent price drop highlights a crucial aspect of the cryptocurrency market – its sensitivity to global events:

- Uncertainty Breeds Aversion: Geopolitical tensions often introduce uncertainty into the global financial landscape. This uncertainty can lead investors to shy away from risky assets like Bitcoin, favoring safer havens.

- The Interconnected World: In today’s interconnected world, events in one region can have ripple effects across globe, impacting financial markets worldwide, including cryptocurrencies.

- The Rise of Geopolitical Risk Analysis: As relationship between geopolitical events and crypto prices becomes clearer, investors are likely to incorporate geopolitical risk analysis into their investment strategies.

This evolving dynamic necessitates a multi-faceted approach to understanding the price movements of Bitcoin and other digital assets.

A Look Ahead: The Future of Bitcoin in a Volatile World

The recent price drop raises questions about the future of Bitcoin in a world fraught with geopolitical tensions:

- Increased Volatility: The relationship between geopolitical events and crypto prices suggests that Bitcoin might continue to experience periods of high volatility. & making it riskier investment proposition for some.

- The Maturation of the Market: As the cryptocurrency market matures, it might become less susceptible to external shocks, including geopolitical tensions. This can lead to greater stability in Bitcoin prices overall.

- The Search for Safe Havens: Some argue that Bitcoin could evolve into safe haven asset itself, as traditional safe havens like gold might not offer same level of protection in digital age.

The future of Bitcoin and its relationship with geopolitical events remains an open question. However, this incident serves as a valuable learning experience for investors as they navigate the ever-evolving world of cryptocurrency.

Conclusion: Navigating a Volatile Landscape

The recent price drop of Bitcoin highlights the complex interplay of market forces, investor sentiment, and geopolitical events. While the long-term trajectory of Bitcoin remains uncertain, this event serves as reminder of inherent volatility of cryptocurrency markets. Investors need to be aware of various factors that can impact price of Bitcoin and develop risk management strategy to navigate this volatile landscape. As cryptocurrency market matures and relationship between Bitcoin and global events becomes clearer, we can expect more informed and resilient investor base moving forward.

Article Link: https://www.brecorder.com/

+44 747720 4635

+44 747720 4635

Comments are closed